The Tidwell Report

Real Estate Looks Good In 1st Half of 2020

December 14th, 2019

Real Estate Looks Good In 1st Half of 2020

December 14th, 2019

A Great Trade Deal May Be Bad News For Homebuyers

If a trade deal is great for the country, it may not be great for mortgage interest rates. A trade deal with substance will drive stocks higher and mortgage rates higher as investors move out of less risky positions and seek greater returns from stocks. If rates creep above 4%, this will increase borrowing costs and eat into how much buyers can afford. Should rates jump above 4.5%, this could force a significant number of home buyers to put their home search on hold, which may limit home price appreciation in the first half of 2020.

As I’ve said in the past, our local home prices are unlikely to suffer unless our local economy and employment take a hit. I do not recommend putting a search on hold because interest rates do not appear to be dipping back down to their historic lows and because home prices will likely face upward pressure from increased demand as we move into Spring.

4th Fed Rate Cut Unlikely…For Now

The Fed is signaling that a 4th successive rate cut is not under consideration at this time, but it will be closely monitoring international developments, signs of weakness in foreign economies, progress on a substantive trade deal, and inflation.

Possible Silver Lining For Real Estate Market

Employment remains strong, consumer confidence is up, and the economy continues to grow.

In spite of a significant trade deal happening, the 2020 presidential race could heat up, frighten investors, and put the stock market in check as could some international concerns that have taken a backseat lately.

If inflation lags for a sustained period below the 2% target set by the Fed, I’d expect the Fed to follow up with another rate cut in 2020–I don’t know they will be as slow to act this time around if further evidence of a slowdown materializes, but the Fed is definitely attempting to exercise restraint.

All of that could send rates lower, benefiting both buyers and sellers because buyers will be able to afford more home for a given payment and sellers will be able to benefit from more buyers bidding on their homes.

If you would like to learn how to orchestrate a bidding war for your current home, or emerge as the successful bidder from a bidding war for your dream home, feel free to call or text me: 310.383.3632.

Good News For Existing Homeowners

Home sales data should be released next week so November home sales will be included in next week’s report, but all signs suggest homeowner equity is up. Homeowners with a mortgage – about 64% of all homeowners – saw their equity increase by 5.1% since Q3 of 2018, according to the Q3 2019 home equity analysis from CoreLogic.

Homeowners With Upside Down Mortgages Is Down 10% From Last Year

Meanwhile, the total percentage of homeowners with mortgages that were upside down was 3.7% in the third quarter, which was down 4% from the prior quarter and down 10% from the third quarter of last year.

Interestingly, 10 years ago during the depths of the Great Recession, 25% of homeowners with mortgaged homes were upside down so that is a significant improvement. CoreLogic’s chief economist credits this massive decline in underwater homeowners to more than 8 years of employment growth and rising prices.

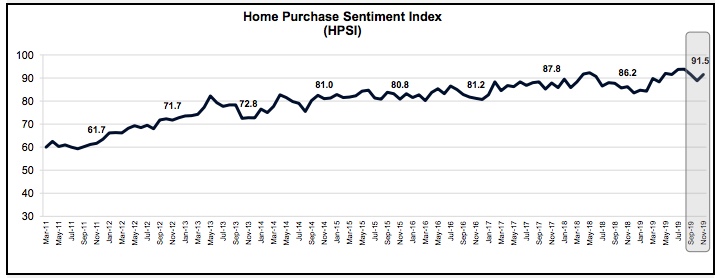

Attitudes Toward Home Buying On The Rise Again

After a steep dive in October, America’s attitude toward buying a home is on the rise again according to the Fannie Mae’s November National Housing Survey (a survey of 1,000 respondents, both renters and homeowners).

More on the pulse of the economy:

STOCK MARKETS

*markets rise on trade deal*

A limited trade agreement in principle was announced this week between the U.S. and China. This deal calls for halting the trade war. President Trump stated that with this “phase one” agreement new tariffs that were set to take effect Sunday will not be enacted, and tariffs placed on some Chinese goods in September will be cut from 15% to 7.5%. China will reduce tariffs on some U.S. goods. They also agreed to increase purchases on U.S. agricultural goods.

This was just one week after President Trump said he was in no rush to make a deal which caused stocks to fall last week. News of an impending deal began to leak out early in the week and an announcement was made Friday that a limited trade deal had been struck. Once again markets closed the week at new record highs.

By The Numbers:

US TREASURY YIELDS

*no significant changes*

MORTGAGE RATES

*slightly higher this week*

The December 12, 2019 Freddie Mac Primary Mortgage Survey reported mortgage rates for the most popular loan products as follows:

Have a great weekend!

Copyright © 2020 Kevin Tidwell Real Estate, All rights reserved.

The Tidwell Report – The House Votes To Kill The Cap on the $10K Real...

The Tidwell Report – The House Votes To Kill The Cap on the $10K Real...