The Tidwell Report

Nobody expected median prices to decline back in March when the 1st quarantine was imposed

August 23rd, 2020

Nobody expected median prices to decline back in March when the 1st quarantine was imposed

August 23rd, 2020

There is significant good news surrounding the housing market out there if you kept up with the headlines. I’ve never seen rates as low as they have been over the past 4 weeks…it has been incredible.

Median prices are up and existing home sales in California are reaching pre pandemic norms but we will not know for a few months home much the recent increase in sales is attributable to new demand vs sales that would have happened anyway without the strict quarantine orders that virtually shutdown buying activity during what was anticipated to be a very busy Spring buying season. The economic downturn has so far disproportionately hit low-wage sectors (mostly in the retail and hospitality sectors) where fewer people tend to have the money to purchase a home in the first place.

The housing market is attracting those in a position to purchase for a variety of reasons, including:

– super low interest rates;

– they want out of an apartment and into a home with more space or a yard;

– they want a bigger home with more bedrooms, a larger yard, or a pool;

– they want to pay their own mortgage rather than a landlord’s mortgage;

– they have more time and energy to shop for a home while working from home;

– they want to lock in their $250K ($500k) capital gains tax free, and restart the clock on a new home;

Bidding wars make it difficult for many buyers to get into a new home, but those buyers who won their bidding bids and the sellers accepted their offers prior to the 1st week of August significantly benefited from the rapid uptick in prices seen this summer in less urban places.

In fact, four weeks ago, I secured an off-market home prior to the builder completing the remodel and going on the market. We negotiated the deal, and both the builder and I recently commented that the home would sell in today’s market for at least $100K more than the builder sold it to us for just 4 weeks earlier—we are about to close escrow. These opportunities are super rare in this type of market, but I enjoy it when I am able to make something off-market happen like this for my clients!

The heightened market activity combined with low inventory has pushed sale prices significantly higher than the most recent comparable sales show—remember comps only show market activity from 30-45 days ago—the home sales being reported are those that under contract in June and July! The competitive edge that Sellers enjoy today is the highest I’ve seen it recent years.

If you or someone you know is considering a move, please let me know as we are still working with a few more buyers who are looking for their future homes. Selling a home during a pandemic is significantly different than selling one pre-pandemic, and having the right advisor in your corner can be a huge difference-maker.

Mortgage rates are expected to remain favorable for a very long time, and it normally takes several months for home prices to find their new norm when interest rates dip (in this case, they have fallen from 5% in November of 2018). Because of this and the lack of supply, we expect home prices to continue upwards until there are significant changes to demand or supply particularly in those areas that are desirable post pandemic, like the suburbs.

Consumer spending remains stronger than expected

The number of active forbearance plans appears to have peaked (more below)

The stock markets avoided large swings in volatility since the early days when nobody had any certainty of what was going to happen next (though this could change with the election approaching or more Coronavirus spikes across the counters)

CALIFORNIA EXISTING-HOUSING SALES

*record sales in July*

The California Association of Realtors announced that existing, single-family home sales in July totaled 437,890 on a seasonally adjusted annualized rate. That marked a staggering month-over-month increase of 28.8% from the number of sales in June. Year-over-year sales were up 6.6% from July 2019. July 2019 had a pretty healthy sales rate, so a 6.6% increase is remarkable considering that we are in the middle of a pandemic. Existing-home sales are recorded sales. These represent homes that went under contract mostly in May and June.

The state-wide median price also hit a record high. It was $666,320. That marked a 6.4% increase month-over-month from June, and a 9.6% increase year-over-year from July 2019. The median price is the point at which one half the homes sell for more and one half sell for less.

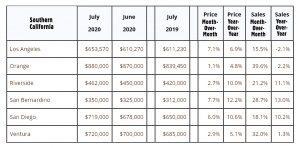

Historic low interest rates with 30-year fixed mortgages at or under 3% combined with tight inventory levels have pushed prices up. The unsold inventory index in July dropped to a 2.1-month supply of housing from a 3.2-month supply one year ago. The index indicates the number of months it would take to sell the supply of homes on the market at the current rate of sales. The graph below indicates the number of sales and median prices for counties in Southern California.

FORBEARANCE

Over the past 30 days, the number of active forbearances plans has declined by 202,000 (-5%). As of August 18, 3.9 million homeowners remain in active forbearance plans, representing 7.4% of all active mortgages, unchanged from last week.

The ongoing COVID-19 pandemic and the expiration of expanded unemployment benefits last month are two of many factors that continue to pose uncertainty as we move forward.

STOCK MARKETS

*Stocks had another strong week*

This week the S&P 500 reached a record high. The NASDAQ is also at a record high. Markets have seen a tremendous recovery from their low levels in March. Real estate sales in July showed their highest month-over-month increase in history, and corporations are reporting strong results.

By The Numbers:

The Dow Jones Industrial Average closed the week at 27,930.33, unchanged from 27,931.02 last week. It’s down 2.1% year-to-date.

The S&P 500 closed the week at 3,397.16, up 0.7% from 3,372.85 last week. It’s up 5.1% year-to-date.

The NASDAQ closed the week at 11,311.81, up 2.7% from 11,017.12 last week. It’s up 26.1% year-to-date.

US TREASURY YIELDS

*closed down over prior week*

The 10-year treasury bond closed the week yielding 0.64%, down from 0.71% last week.

The 30-year treasury bond yield ended the week at 1.35%, down from 1.45% last week.

MORTGAGE RATES

*almost unchanged, or moving up*

The August 20, 2020 Freddie Mac Primary Mortgage Survey reported mortgage rates for the most popular loan products as follows:

The 30-year fixed mortgage rate average was 2.99%, almost unchanged from 2.96% last week.

The 15-year fixed was 2.54%, up from 2.48% last week.

The 5-year ARM was 2.91%, unchanged from 2.90% last week.

TENANTS FLEE APARTMENTS

*apartment rent hikes cease and are expected to fall as tenants move in with parents, out of the area, or into single family home rentals*

An article in the OC Register featured a dramatic title, “Decade of Rent Hikes End in L.A., Orange counties” The coronavirus had a lot to do with this and why there is now a decline, but it isn’t until you read the article does it reveal that this is for apartments! The rental prices of single family homes may not be suffering as much as apartments (or at all). In fact, several homes that I am aware of have been leasing for above asking prices. The fact is that prospective tenants are in search of safe space away from their fellow citizens, which they cannot necesarrily get with apartments, condos, or townhouses. Because more people are working remotely, some renters have become “digital nomads,” moving from city to city and many well-paid white-collar workers who are working from home and might want out of a cramped apartment, especially when the mortgage rates are hitting all time lows.

Still, the forecasted drop in rental prices for apartments is only 3-4% by year end for LA, OC, and Ventura Counties. I’ve seen a lot apartments and newly constrcuted apartments offering concessions as way to compete for renters. This will be interesting to watch because it will sensitive to what goes on in the economy in Q3 and Q4 of this year and into next.

LANDLORD ISSUES

*not the time to be a hobby landlord*

Meanwhile, being a landlord has become a national nightmare since 13% of tenants in the US skipped their payment in August, and more are expected to fall behind in September. In the months following the pandemic quarantines, governments stepped in to save both tenants from eviction (and homeowners from foreclosures) by setting up moratoriums and allowing them to shelter in place if they had been affected by the pandemic. This is a potential looming disaster. For example, California’s eviction moratorium is set to end September 1st. That means California Governor Newsom faces this eviction cliff if nothing is done.

CALIFORNIA FIRST TIME JOBLESS CLAIMS

*Improvements underway in CA’s employment*

The good news is that California recorded the fewest first-time unemployment claims since the Coronavirus lockdown on businesses began. While these claims did fall, they remain elevated at 4-5 times what they were prepandemic. In other good news, the four-week moving average of unemployment claims in California also showed a marked improvement–the moving average smooths out weekly gyrations in the numbers. Over the most recent one-month period, the number of unemployment claims in California fell below 900,000 for a four-week stretch for the first time since the end of May. The current one-month pace of unemployment claims is greatly improved from the worst time periods of the business shutdowns in California. Meanwhile, SoCal employers hired 225,500 people in July lifting overall employment in California to 88% of its’ prepandemic levels with an unemployment rate at 15.9%.

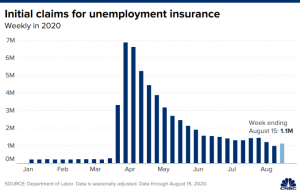

US FIRST TIME JOBLESS CLAIMS

*bounced back up above 1M this week— experts expect further turbulence moving forward*

Economists surveyed by Dow Jones forecast 923,000 first-time US jobless claims for the week ending on Aug.15 but the figure was 1.106 million. The week prior marked the first time in 21 weeks that initial claims came in below 1 million. recent The uptick raised further concerns about where the economy is headed, weeks after $600-a-week supplementary jobless benefits lapsed.

At first, the numbers for CA and the US appear so close together but CA is quoted for the monthly initial jobless claims while the US is quoted for the weekly initial jobless claims for those regions respectively.

Copyright © 2020 Kevin Tidwell Real Estate, All rights reserved.

Unique and Spacious Turn-Key Home in Valley Glen

Unique and Spacious Turn-Key Home in Valley Glen