The Tidwell Report

The housing market is on fire!

July 25th, 2020

The housing market is on fire!

July 25th, 2020

On June 24th, we welcomed a new family member into the world so I put writing The Tidwell Report on pause for a few weeks to spend time with the family. Meet Cooper:

FEATURED LISTINGS

1,900+ SQ FT Luxury Penthouse Condo with no common walls in the heart of Studio City – link

Mid-Century Charmer on a 1/3 acre lot in the Hollywood Hills with a salt water pool & EPIC views – link

MARKET UPDATE

A lot has happened in the real estate market since the last update. In fact, the market is red hot and getting hotter.

* The greatest challenge is low inventory

* The greatest gift is low interest rates

In simple economic terms, there is strong demand for the comparatively few homes that are on the market. When the current homes under contract from the past 45 days close escrow and become sold listings, a lot of buyers will wish they had more aggressively pursued the homes they offered on previously because the next home they find desirable will cost more as a result of these new comps.

That means higher prices for most of the California housing market.

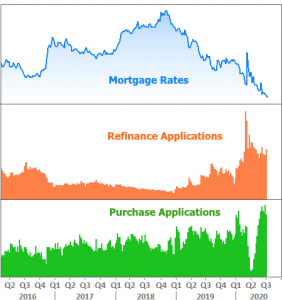

Image courtesy of Dennis Oleesky, Citibank Loan Officer

Trends:

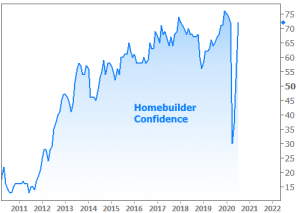

– Record-low interest rates are here to stay — almost all rates should start with a 2.XX%

– Low rates are responsible for record-level purchase applications, for generating significant demand for mortgage refinances, and for restoring builder confidence post pandemic.

– While home prices in densely populated areas are holding, home prices in desirable areas that are less densely populated are climbing at a fast pace

– People Are Migrating To The Suburbs–something they swore they would never consider doing prior to Covid-19!

– Home shopping is now virtual–no more looking at a home just for fun!

– All showings are by private appointment — Public open houses are prohibited

Young professionals, families, and older couples are moving to the suburbs to maintain their sanity, activity levels, and to be closer to family members. They want larger properties with a view, a yard, more bedrooms, or pools. In fact, data obtained from polls taken from April to June found that the top moving motivators include the need for space (44%), a desire to buy versus rent (41%), and to relocate to the suburbs (37%). A huge priority for families is both finding a way to keep kids engaged at home especially if they do not go back to school any time soon and getting enough additional square footage for a quiet, dedicated work space that their old homes could not provide.

I have clients moving from ultra densely populated cities, like NY and SF, to Los Angeles because the quality of life in those cities “is no longer what it used to be.” The ability to work in Los Angeles, the fact that they have friends and family here, and that the weather cannot be beaten has made LA a more attractive destination, especially for young professionals.

Clients who live in the city are moving to the surrounding communities where they can get more for their money or buy their first home. Meanwhile, clients who feel that they do not need to be in LA to work are selling their homes and leaving LA for even more remote places around the country.

With a halt to the economy reopening and the winter flu season around the corner, buyers are wasting little time as they realize they may never go back to work in a typical corporate office setting. If more workers understand that their future involves working remotely, I could see this trend pick up further steam since many of them may decide they prefer a bigger house in a less-congested neighborhood or a home in a more affordable region.

According to weekly data from realtor.com, homes are selling faster than they did in 2019, when no one had heard of COVID-19. With the return of bidding wars,first-time and trade-up buyers who have lost out on other homes are competing harder with more buyers.

Nearly two-thirds of consumers, 61%, said it was a good time to buy a home in June, in a Fannie Mae housing survey of 1,000 participants. That was a 9-percentage point increase from May. Roughly 41% of respondents said it was a good time to sell, also an increase of 9 percentage points from the previous month.

I recently listed a home in the Hollywood Hills with stellar views from both the home and the pool, and I received 30+ calls to show it (http://MidCenturyCharm.com) on the first day. Interestingly, the vast majority of these buyers have already lost out on multiple bidding wars so when something remotely desirable comes on the market, they flock to it. Because my phone continued to ring and ping from agents insisting that my clients wait to accept an offer until after they could show it to their buyers, my clients requested that I show it one more weekend in spite of already receiving 5 offers. I’ll let you know how this weekend goes!

Low mortgage rates are increasing buyers’ purchasing power overnight. One client locked in a rate of 2.75% on a 30 year fixed purchase! His purchasing power went up an additional $150,000 from what it was a few months ago. Lower rates not only fuel buyers’ purchasing power, but they also creates a new crop of buyers who can qualify to buy a home. Those two factors contribute to higher real estate prices particularly when inventory is low. Usually, it takes several months for home prices to find their new normal after interest rates drop and demand intensifies so we will likely see record breaking median prices (at least in LA). The farther rates fall, the higher prices go.

With rates this low, some renters can now buy a home for not much more than what they currently pay in rent. Because many experts believe low interest rates are here to stay, I expect demand to remain strong for quite some time.

On the supply side, we knew Los Angeles (and other parts of Southern California) in particular had a shortage of affordable or desirable homes in comparison to demand. Covid-19 made that critically worse.

Based on Zillow data, owners listed 5,117 existing homes for sale (ie. new listings) in the week ended July 18 for Los Angeles, Orange, Riverside, and San Bernardino counties. This, according to Jonathan Lansner of the OC Register, is a 3% increase over the prior week, and it is the largest increase to the housing inventory in 19 weeks, or since March 7th.

Still, new listings are down 13% from a year earlier and overall home inventory in these counties is also down 32% over the year prior. This is one reason that many experts point to when explaining why total home sales dropped so much–if there are fewer homes for sale, then home sales would in theory be lower for that period.

3,696 existing homes went under contract last week, which was 6% more than the previous seven days. That is the 11th positive week for pending purchases out of the last 13 weeks as the housing market rebounds from the “stay at home” orders and the fallout from the quarantines, which were designed to slow the pandemic’s spread.

I do not expect a dramatic uptick in supply that is nearly enough to counter the market forces driving demand up because I do not see an abrupt end to government stimulus or to government support until the world:

makes serious progress on curtailing Covid-19 and

the global economy has a chance to start recovering

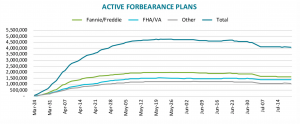

Even with attempts to decrease stimulus, I still see government officials working to reduce the negative impact that the quarantines have had. I anticipate that they will do this by drawing out any opportunity for lenders to foreclose on homeowners who cease paying their mortgages, and by giving those homeowners an opportunity to get back on their feet once the economy resumes and Covid-19 is under control. Lenders may also face an uphill battle pursuing foreclosure proceedings because of the backlog of court cases, which could buy these homeowners enough time to find employment and work out a deal, or to sell in take out their equity even after paying the lender. For the reasons above, I do not see a high volume of foreclosures any time soon that could cause home prices to decline.

FORBEARANCES

According to Black Knight Inc., the number of active forbearance cases this week was about the same (very slightly up) after 3 consecutive weeks of declines.

VIEWING HOMES IN PERSON & VIRTUALLY

While public open houses in CA are not allowed, we are still able to safely show homes by private appointment, limiting the number of people inside a home at one time and only while wearing masks (and sometimes gloves and booties if the seller prefers). We go through a lot of disinfecting wipes when we wipe down all of the surfaces, handles, and knobs between showings. Even with these new limitations on house viewings, I see a lot of buyers coming back into the market. Some are even buying homes without ever stepping foot in the home they are buying since they rely on 3D tours, videos, 2D floorplans, virtual walkthroughs, and live video tours by real estate agents.

HOME SALES DATA FROM THIS WEEK FOR LA & OC COUNTIES

*New escrows over past 7 days*

2,184 contracts signed

up 10% in a week

up 7% in a month

flat over 12 months.

New escrow over past 30 days

9,081 new escrows

down 3% in a year. That’s an improvement compared from falling at a 14% rate four weeks earlier.

New listings over the past 7 days

3,206 new homes on the market

up 1% vs. the previous week

up 12% in a month

down 10% in a year

New listing over past 30 days

12,873 new homes on the market

down 15% in a year. That’s an improvement compared to falling at a 17% rate four weeks earlier.

Total inventory

17,379 homes on the market

flat in a week

up 0.3% in a month

down 27% over 12 months.

CA EXISTING HOME SALES

*rebound in June*

Home sales bounced back solidly in June after hitting a record bottom in May, as lockdown restrictions loosened and pent up demand driven by record-low interest rates roared back

The California Association of Realtors announced that:

Existing home sales surged 42.4% in June from May‘s sales totals.

Existing home sales totaled 339,910 on a seasonally adjusted annualized rate in June. That was down 12.8% from June 2019.

Fortunately, pending sales have also increased dramatically. The California Association of Realtors expect sales to be back to pre-pandemic levels by July or August.

Prices also surged in June. The state-wide median price paid for a home in June was $626,170. That represented a 6.5% increase from May and a 2.5% increase from last June.

Inventory levels declined to a 2.7 month supply of homes for sale which explains the number of homes selling with multiple offers.

ON A REGIONAL BASIS

Median prices from over a year ago also increased in Los Angeles County (+1.8%), Ventura County (+8.2%), and Orange County (+3.3%).

U.S. EXISTING HOME SALES

*U.S. existing home sales rebounded at a record pace in June*

The National Association of Realtors announced that:

Total existing-home sales, which include single family, condominium, townhomes, and co-ops, increased 20.7% in June from the number of sales in May. This reversed three months of sales declines caused by the pandemic.

Real estate sales in all regions of the country reported record month over month increases in sales.

The number of sales was still down 11.4% from the number of sales last June, but pending sales have increased and the N.A.R. and associations around the country expect sales to be back up to last year’s levels in the next two months.

The median price paid for a home was up 3.5% from the price paid last June. Inventory levels dropped to a 4 month supply, down from 4.3 months one year ago.

EMPLOYMENT

*Employers added 4.8 million jobs in June*

The Department of Labor and Statistics reported that 4.8 million new jobs were added in June. That eclipsed analysts’ expectations of 2.9 million new jobs.

UNEMPLOYMENT

*Initial jobless claims measured at 1.3M*

Initial unemployment claims totaled 1.3 million last week, according to the Labor Department, surpassing the 1.25 million economists polled by Dow Jones had expected. The unemployment rate dropped to 11.1% from 13.3% in May. It was 14.7% in April, the highest reading since the Great Depression, so the last two months have shown a very positive trend.

STOCK MARKETS

*dropped slightly this week*

Following three straight weeks of gains, stocks retreated at the end of the week. The drop for the week was not significant, but stocks were up all week before retreating more sharply on Thursday and Friday. Key developments that caused investors to pull back were: U.S. China tensions are increasing over the accusations of China’s start, disclosure and response of the coronavirus. Chinese hacking and theft of intellectual property, including technology, business data, and coronavirus vaccine research. This led to an arrest of two Chinese Hackers and the U.S. ordering the Houston Chinese Consulate to shut down, which was followed by China closing a U.S. consulate in Chendgu. Jobless claims rose reversing eight weeks of steady employment gains gains. The senate failed to get a stimulus package passed. It is feared that a package may not pass before many provisions, including pandemic unemployment benefits expire next week.

By The Numbers:

The Dow Jones Industrial Average closed the week at 26,469.89, down 0.8% from 26,671.95 last week. It’s down 7.3% year to date.

The S&P 500 closed the week at 3,215.63 0.3% from 3,224.73 last week. It’s down 0.5% year to date.

The NASDAQ closed the week at 10,363.18, down 1.3% from 10,503.19 last week. It’s up 15.5% year to date.

U.S. TREASRUY BOND YIELDS

*dropped this week*

The 10-year treasury bond closed the week yielding 0.59%, down from 0.64% last week.

The 30-year treasury bond yield ended the week at 1.23%, down from 1.33% last week.

MORTGAGE RATES

*slightly higher on average*

The July 23, 2020 Freddie Mac Primary Mortgage Survey reported mortgage rates for the most popular loan products as follows:

The 30-year fixed mortgage rate average was 3.01%, almost unchanged from 2.98% last week.

The 15-year fixed was 2.54%, up from 2.48% last week.

The 5-year ARM was 3.09%, up from 3.06% last week.

US RETAIL SALES

*up in June*

US retail sales rose 7.5% last month, with clothing and accessories retailers seeing a 105.1% uptick over May and overall sales rising 1.1% from June 2019, according to the Commerce Department. It marks the first year-over-year increase since the pandemic began, but the recent rise in COVID-19 cases across the country makes future recovery uncertain.

US MANUFACTURING

*expands more than expected*

US manufacturing grew a seasonally adjusted 5.4% in June compared with May, marking the second consecutive month of expansion, according to the Federal Reserve. The gain topped a 4% increase expected by economists.

US housing starts jumped 17.3% in June

US housing starts rose to a seasonally adjusted annual rate of 1.186 million units in June, and the 17.3% gain was the sharpest climb since October 2016, according to the Commerce Department. Economists polled by Reuters had expected a rate of 1.169 million units.

US BUDGET DEFICIT

*rises to monthly record of $864B*

The US budget deficit hit a monthly record high of $864 billion in June as millions of jobs disappeared and government spending accelerated amid the coronavirus pandemic. The deficit for the first nine months of the fiscal year, $2.74 trillion, also is a record.

If you read this far, let me know by hitting reply and you will be entered to win a $20 Alfred’s Coffee gift card.

Have a great Sunday!

Copyright © 2020 Kevin Tidwell Real Estate, All rights reserved.

The Tidwell Report – Nobody expected median prices to do this ? back in...

The Tidwell Report – Nobody expected median prices to do this ? back in...